Estimate employer payroll taxes

An employee will pay 62 Social Security tax on the first 132900 in wages and 145 Medicare tax on the first 200000 in wages 250000 for joint returns. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

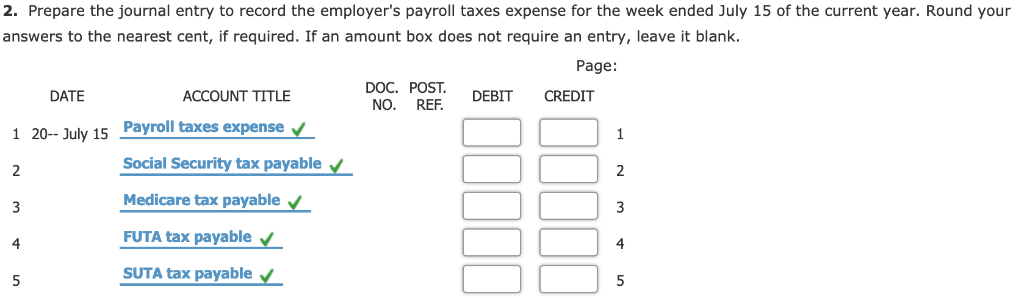

S Corp Payroll Taxes Requirements How To Calculate More

Sign Up Today And Join The Team.

. Simply the best payroll software for small business. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare. Learn About Payroll Tax Systems.

The employer cost of payroll tax is 124. Make Your Payroll Effortless and Focus on What really Matters. Use this tool to.

You can use the Tax Withholding Estimator to estimate your 2020 income tax. Compare Sonarys Most Recommended Payroll Find The Perfect Match For Your Business. The basic process runs down as such.

Social Security is a 124 payroll tax. Get Started for Free. How to calculate payroll taxes how to pay payroll taxes and how to avoid an unfortunate run-in with the IRS.

Social Security of 62 of annual salary 7 Medicare 145 of annual salary Yes you read that right. Ad Fast Easy Accurate Payroll Tax Systems With ADP. Simplify Your Day-to-Day With The Best Payroll Services.

However you can also claim a tax credit of up to 54 a max of 378. Federal State and Local Taxes All Included. Check your tax withholding with the IRS Tax Withholding Estimator a tool that helps ensure you have the right amount of tax withheld from your paycheck.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Depositing and Reporting Employment Taxes. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

Ad Compare Side-by-Side the Best Payroll Service for Your Business. Ad Roll by ADP Runs Payroll in All 50 States. Learn About Payroll Tax Systems.

Ad Check Out Our Best Paycheck Software Reviewed By Industry Experts. Keep in mind that some pre-tax deductions eg Section 125 plans can lower the gross taxable wages and impact how much. For estimated tax purposes the year is divided into four payment periods.

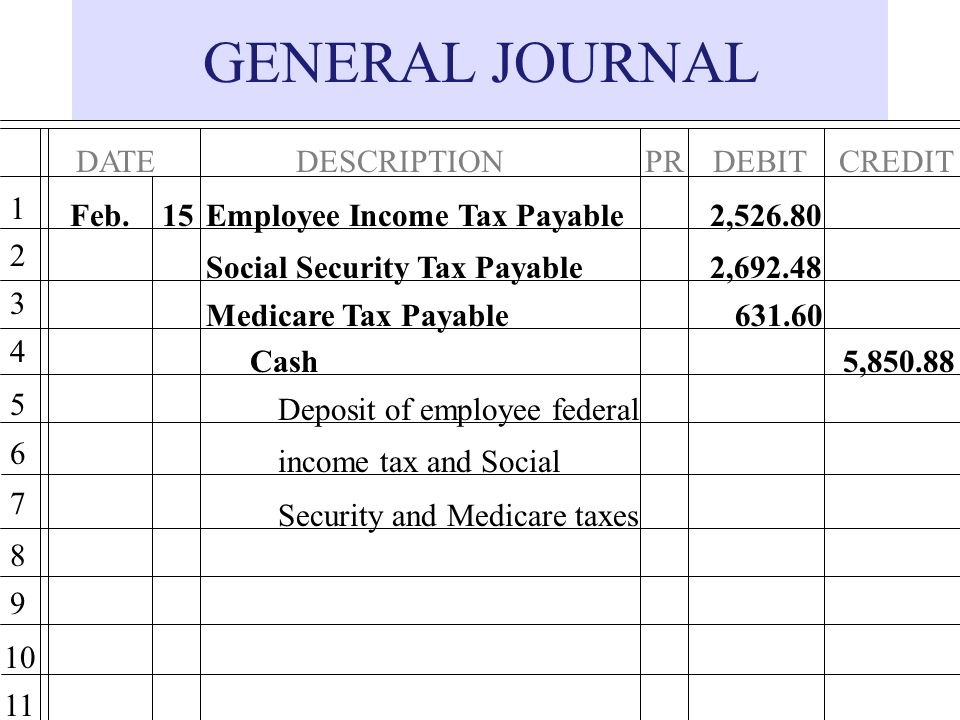

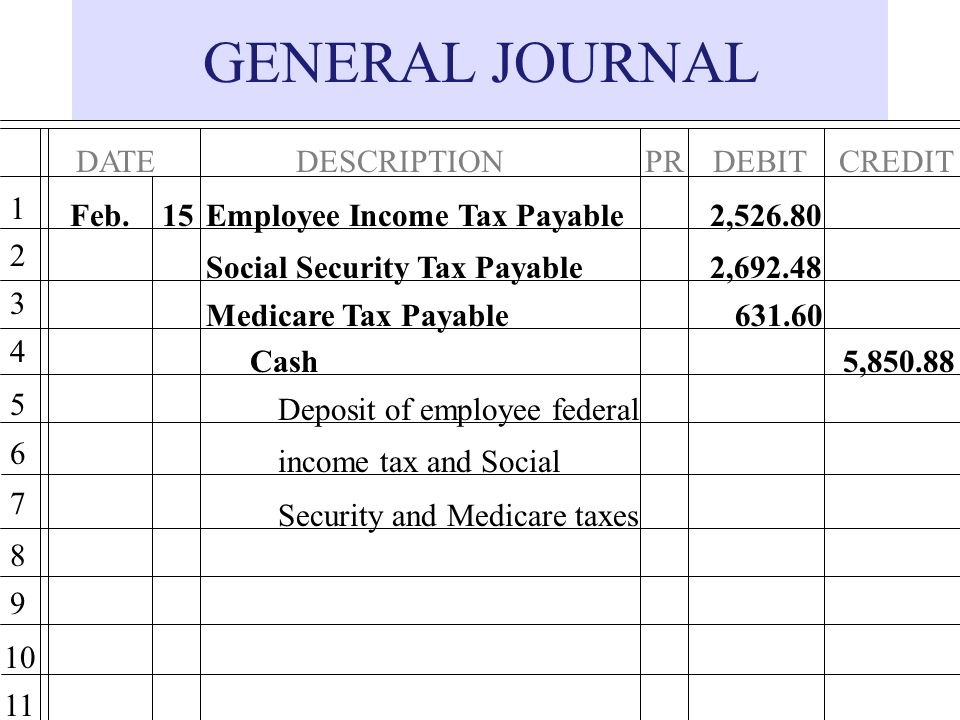

2 Prepare your FICA taxes Medicare and Social Security monthly or semi. Sign Up Today And Join The Team. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

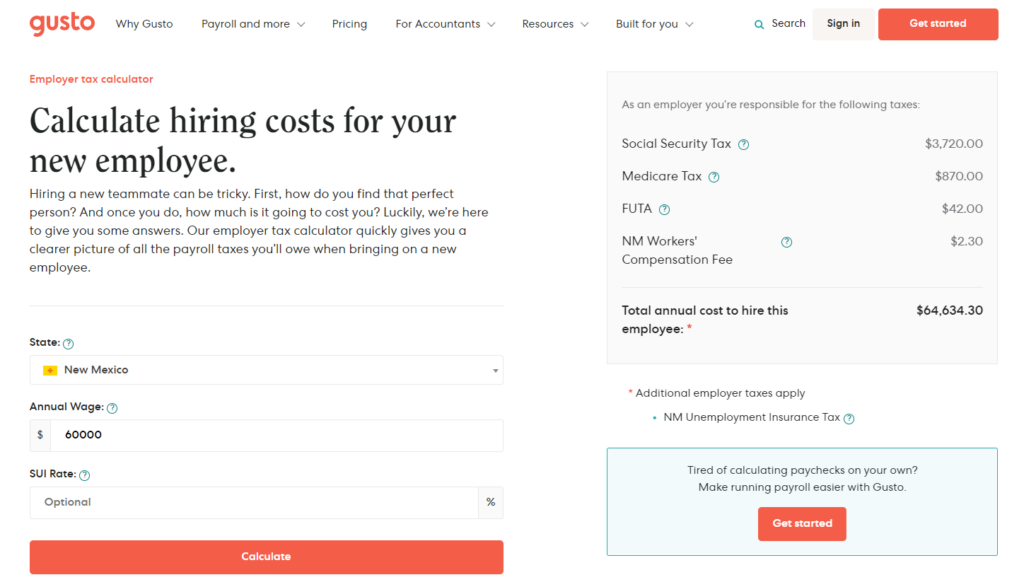

Ad Compare This Years Top 5 Free Payroll Software. For 2020 the Social Security tax will be paid on the first 137700 of wages a 4800 increase from last year. Ad 4 out of 5 customers reduce payroll errors after switching to Gusto.

Its an employer-paid payroll tax that pays for state unemployment agencies. Free Unbiased Reviews Top Picks. Half of these payroll taxes.

How to File Your Payroll Taxes 1 Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator. Over 900000 Businesses Utilize Our Fast Easy Payroll. For example if an employee earns 1500.

2020 Federal income tax withholding calculation. Our employee cost calculator shows you how much they cost after taxes benefits other factors are added up. Subtract 12900 for Married otherwise.

What are some of the payroll taxes that employees pay. In this guide well show you how to calculate employer payroll taxes the taxes you as the employer will pay as well as how much employee tax to remit to the government. Employees cost a lot more than their salary.

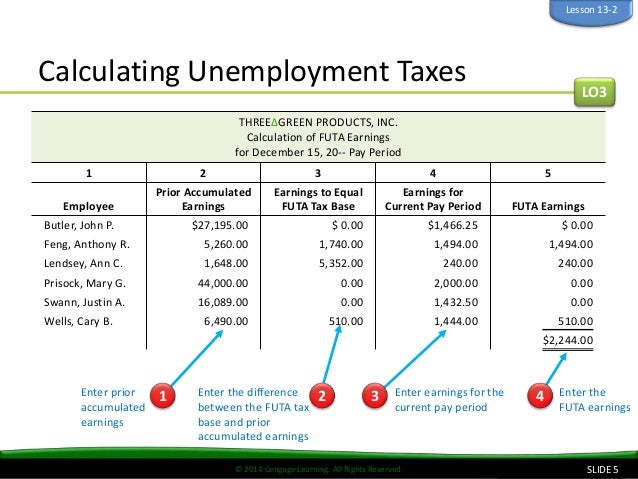

Sign Up and Try for Free Today. The standard FUTA tax rate is 6 so your max contribution per employee could be 420. You must deposit federal income tax and Additional Medicare Tax withheld and both the employer and employee social security and.

Both employers and employees are responsible for payroll taxes. The Tax Withholding Estimator compares that estimate to your current tax withholding and can. Over 900000 Businesses Utilize Our Fast Easy Payroll.

How to calculate annual income. Focus On Doing What You Love--Running Your Small Business. You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from.

The FUTA tax rate is 6 on the first 7000 of wages paid to employees in a calendar year. Ad Get It Right The First time With Sonary Intelligent Software Recommendations. Sign up make payroll a breeze.

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com

How To Calculate Payroll Taxes In 5 Steps

Payroll Taxes How Much Do Employers Take Out Adp

Payroll Paycheck Calculator Wave

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

What Are Employer Taxes And Employee Taxes Gusto

Federal Income Tax Fit Payroll Tax Calculation Youtube

Payroll Tax Calculator For Employers Gusto

Calculation Of Federal Employment Taxes Payroll Services

Payroll Accounting Employer Taxes And Reports Ppt Download

Payroll Tax What It Is How To Calculate It Bench Accounting

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

2022 Federal State Payroll Tax Rates For Employers

How To Calculate Payroll Taxes In 5 Steps

Solved 1 Calculate The Employer S Payroll Taxes Expense Chegg Com

Paycheck Calculator Take Home Pay Calculator